Electric Vehicle Dataset India

Electric Vehicle Dataset India provides comprehensive data on EV adoption, performance, infrastructure, and market trends across India. Ideal for researchers, analysts, and businesses, this dataset includes statistics on EV sales, battery technology, charging stations, and government policies.

Dive into insights on the growing electric vehicle landscape, analyze region-specific data, and explore factors driving EV adoption. With accurate, up-to-date information, Electric Vehicle Dataset India is your go-to source for understanding the dynamics of India’s shift towards sustainable transportation. Uncover detailed data essential for informed decisions and strategic planning in the EV industry.

Table of Contents

Electric Vehicle Dataset India: Trends, Data Insights, and the Future of Mobility

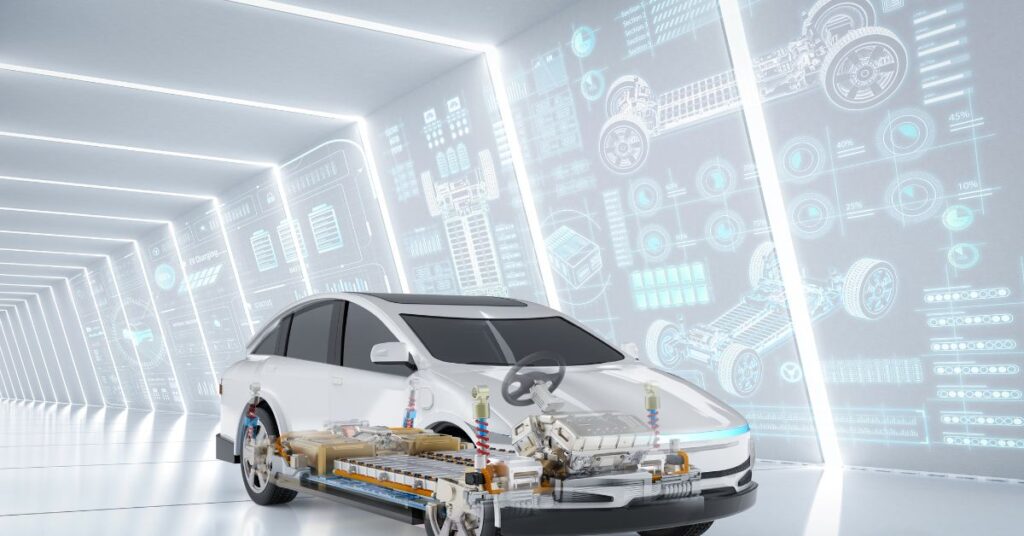

Electric vehicles (EVs) are transforming the way we think about transportation, particularly in India, where concerns about air pollution, fuel dependence, and urban congestion are pressing issues. The Indian government has set ambitious goals to promote electric mobility, aiming for 30% EV penetration in private cars, 70% for commercial vehicles, and 80% for two- and three-wheelers by 2030. This has spurred the need for reliable datasets to analyze trends, market growth, infrastructure needs, and consumer behavior within India’s EV ecosystem.

In this article, we delve into the details of EV datasets specific to India, including data sources, trends in EV adoption, charging infrastructure, policy impacts, and projections for the future.

Overview of EVs in India

- Current State of EVs in India

EVs are gaining momentum in India, especially in the two-wheeler and three-wheeler segments, which dominate the market due to affordability and practicality. Government initiatives, increasing fuel prices, and environmental concerns have spurred growth. - Major EV Players in India

India’s EV market has seen entries from startups like Ola Electric, Ather Energy, and Revolt Motors in the two-wheeler segment, as well as established manufacturers like Tata Motors, Mahindra Electric, and Ashok Leyland in the four-wheeler and commercial segments.

Sources of EV Datasets in India

Reliable datasets are critical for understanding the market dynamics and forecasting trends. Key data sources for EV datasets in India include:

- Ministry of Road Transport and Highways (MoRTH)

Provides vehicle registration data, including EV registrations. - Society of Indian Automobile Manufacturers (SIAM)

Offers data on vehicle production, sales, and exports. - India Energy Storage Alliance (IESA)

Publishes research on battery technology and EV adoption. - Central Electricity Authority (CEA)

Provides data on charging infrastructure and electricity demand. - Government and Private Initiatives

Programs like FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) and datasets from companies like Ather Grid and Tata Power, which contribute to charging station data.

Key Electric Vehicle Datasets and Metrics to Monitor

Here are some crucial metrics and datasets that offer insights into the EV ecosystem in India:

- Vehicle Registration Data

Registration data from RTOs (Regional Transport Offices) shows trends in EV adoption, including details on the types of vehicles registered (two-wheelers, three-wheelers, four-wheelers, etc.). - Battery and Charging Station Data

This dataset includes information about battery types, capacities, lifecycles, and charging station locations. - Market Sales and Demand

Monthly and annual sales data of EVs across different states, regions, and cities highlight regional trends and adoption. - Electricity Consumption and Load Management

Insights into how much electricity is being consumed by EVs and the infrastructure’s capacity for load management, especially with anticipated growth. - Government Subsidies and Incentives

Details on subsidies, such as those provided under FAME, along with state-specific incentives, are critical for analyzing how government support affects the market.

EV Growth Trends in India

- Historical Growth Rates

The EV market in India has shown exponential growth in the last five years. Comparing year-on-year data highlights periods of growth, often aligning with government incentives or rising fuel prices. - State-Wise Adoption

Some states, such as Karnataka, Delhi, and Maharashtra, have shown higher adoption rates due to state-specific incentives. Trends show that urban centers have higher EV penetration compared to rural areas. - Two-Wheelers Leading the Market

India’s two-wheeler EV market is the largest and fastest-growing segment due to high demand for affordable urban transportation. Sales data shows that two-wheelers account for a large portion of overall EV sales.

Charging Infrastructure and its Dataset in India

- Current Charging Infrastructure

As of recent reports, India has approximately 1,000 public charging stations. However, the need is much higher to support the anticipated growth of EVs. Data on charging station locations, capacities, and types (fast vs. slow charging) is crucial. - Challenges in Infrastructure Development

Developing infrastructure for EVs is challenging due to factors such as grid stability, high installation costs, and land acquisition issues. - Government Efforts to Boost Charging Infrastructure

Under FAME II, the government has allocated funds specifically for developing charging stations. Additional incentives are available for private sector investments in EV charging.

Battery Data and Range Analysis

- Battery Composition and Technology

Most EVs in India use lithium-ion batteries due to their high efficiency. Battery datasets provide insights into battery chemistry, lifecycle, recycling, and disposal. - Range and Charging Time

Data on EV range and charging times can help analyze consumer behavior and preferences, as range anxiety remains a common concern for many potential EV buyers.

Policy Impact on EV Adoption and Dataset Tracking

- FAME I and FAME II

The Faster Adoption and Manufacturing of Electric Vehicles (FAME) initiative has been pivotal in driving EV adoption in India. Datasets on vehicle models that qualify for incentives, subsidy amounts, and their impact on sales provide insights into policy effectiveness. - State Policies

States like Delhi, Maharashtra, and Tamil Nadu have introduced their own EV policies. Datasets tracking state-wise incentives, tax exemptions, and charging station installations can help assess the impact of these policies. - Global Policies and Comparisons

Comparing India’s policy framework with global benchmarks offers a perspective on the effectiveness and direction of local initiatives.

Future Projections for EVs in India

- Projected Growth Data

By 2030, India’s EV market is expected to grow at a compound annual growth rate (CAGR) of over 40%. Projected data for different segments—two-wheelers, commercial fleets, buses, and personal cars—highlights where the focus may shift in the coming years. - Impact on Energy Demand

Increased EV adoption will lead to higher electricity demand. Datasets on projected energy consumption for EVs can help in grid planning and identifying the need for renewable sources. - Role of AI and IoT in Future EV Datasets

The future of EV data collection in India will likely involve AI and IoT to gather real-time data on traffic, battery health, and charging patterns. This data will help optimize infrastructure and enhance user experience.

Challenges in Data Collection and Accuracy

- Inconsistent Data Sources

India’s fragmented regulatory framework often results in inconsistent data sources and reporting standards across states. - Data Privacy Concerns

As data collection becomes more sophisticated, concerns around data privacy and security are growing. Addressing these concerns is essential for maintaining public trust. - Need for Standardized Data Collection

A centralized and standardized system for EV data collection can improve data reliability and accessibility for stakeholders.

FAQs About Electric Vehicle Dataset India

India’s electric vehicle journey is just beginning, and as the market grows, the need for comprehensive datasets will only increase. Access to reliable data will enable better planning, policy-making, and infrastructure development, supporting India’s vision of a sustainable transportation future.

Click here to learn more about the Electric Vehicle Dataset India