Electric Vehicle Battery Stocks

Electric Vehicle Battery stocks represent companies involved in the production, development, and supply of batteries for electric vehicles. These stocks are crucial to the growing EV market, offering investors opportunities to capitalize on advancements in battery technology, sustainability trends, and the global transition towards cleaner energy and electric mobility solutions.

Electric Vehicle Battery Stocks: A Comprehensive Guide

The electric vehicle (EV) market is rapidly transforming the global automotive landscape, and with it, the demand for EV batteries is skyrocketing. Investors are increasingly eyeing electric vehicle battery stocks as a lucrative opportunity as the world pivots towards cleaner and more sustainable energy solutions. This blog post delves into the intricacies of EV battery stocks, exploring market trends, key players, and future growth prospects.

1. The Rise of Electric Vehicles

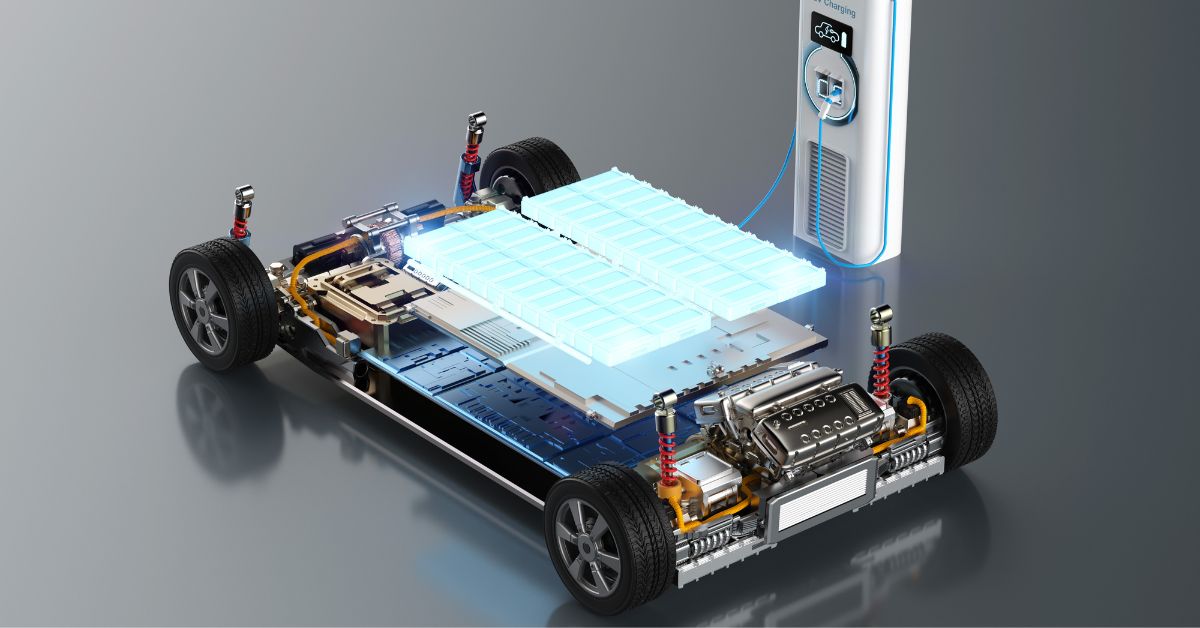

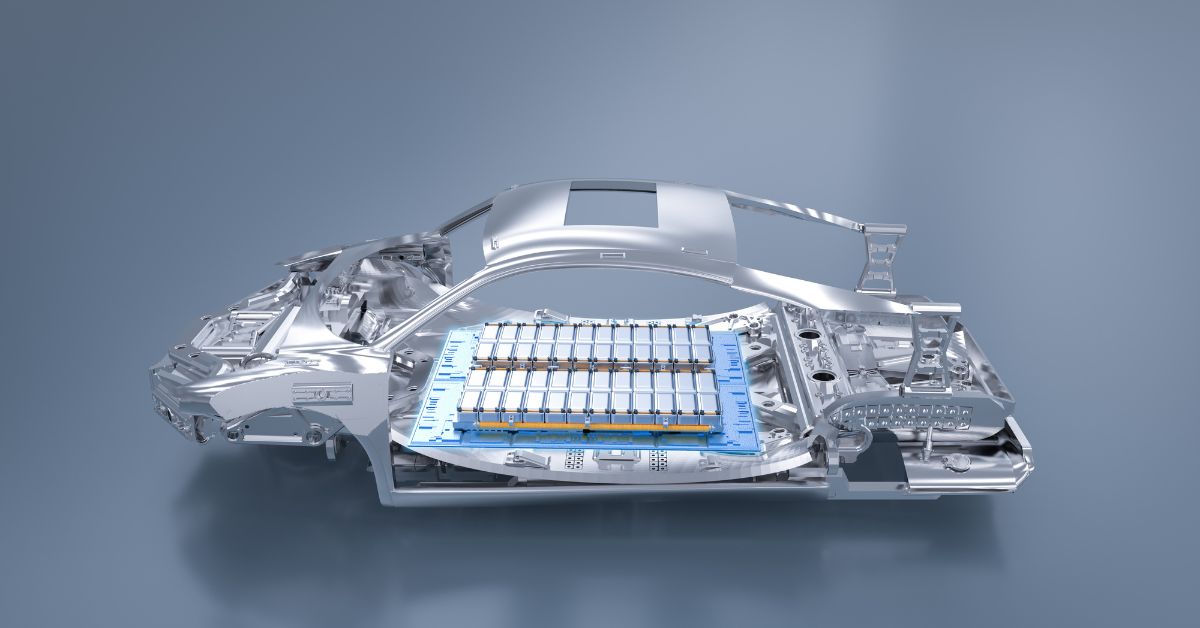

The shift from internal combustion engine (ICE) vehicles to electric vehicles is one of the most significant transitions in the transportation industry. This transformation is being fueled by factors such as environmental concerns, government regulations, and technological advancements. As the number of EVs on the road continues to grow, so does the demand for batteries, the heart of electric vehicles.

The EV market is expected to reach $1.3 trillion by 2030, with global sales exceeding 30 million units annually. A key component driving this growth is the battery, which powers these vehicles. Consequently, the market for EV batteries is expected to witness exponential growth, making it a prime area of interest for investors.

2. Understanding Electric Vehicle Batteries

The battery is the most crucial component of an EV, determining its range, performance, and overall cost. The majority of electric vehicles today rely on lithium-ion batteries due to their high energy density, longer lifespan, and efficiency. However, other battery technologies, such as solid-state batteries, are being developed and may soon revolutionize the industry.

Types of EV Batteries

- Lithium-Ion Batteries: The most common type used in EVs, known for their high energy density and long life.

- Nickel-Metal Hydride Batteries: Less common in EVs, often used in hybrid electric vehicles.

- Solid-State Batteries: Emerging technology with the potential to offer higher energy density and improved safety compared to lithium-ion batteries.

- Lithium-iron phosphate (LFP) Batteries are gaining popularity, especially in China, due to their stability, affordability, and longer cycle life.

Importance of Battery Efficiency

As the primary source of energy in an EV, the efficiency of the battery is a key determinant of an electric vehicle’s performance. Manufacturers are focusing on improving battery technology to increase driving range, reduce charging time, and lower costs. These advancements are pivotal in making EVs more accessible and attractive to consumers.

3. EV Battery Market Overview

The EV battery market is poised for remarkable growth, driven by the surge in electric vehicle adoption worldwide. Governments are imposing stringent regulations on emissions, and auto manufacturers are making substantial investments in electric mobility. This has led to a burgeoning demand for batteries, making EV battery stocks an attractive investment option.

According to industry estimates, the global EV battery market is projected to grow from $27 billion in 2021 to over $127 billion by 2027. This growth presents significant opportunities for investors looking to capitalize on the rising demand for EVs and the batteries that power them.

Key Factors Driving Market Growth

- Government Policies and Incentives: Many governments offer subsidies, tax rebates, and incentives to promote EV adoption, directly benefiting the battery industry.

- Technological Advancements: Innovations in battery technology, such as solid-state batteries, are enhancing the efficiency and lifespan of EV batteries.

- Rising Environmental Awareness: As consumers become more eco-conscious, the demand for zero-emission vehicles increases, further driving the EV battery market.

4. Top EV Battery Manufacturers

Several companies dominate the EV battery manufacturing sector. These players are crucial to the electric vehicle supply chain and are positioned to benefit from the growing EV market.

Contemporary Amperex Technology Co. Limited (CATL)

CATL is the world’s largest EV battery manufacturer, based in China. The company supplies batteries to major automakers, including Tesla, BMW, and Volkswagen. CATL’s lithium-ion batteries are renowned for their quality and performance, making it a significant player in the EV battery market.

LG Energy Solution

A subsidiary of LG Chem, LG Energy Solution is a leading supplier of lithium-ion batteries for electric vehicles. The company has partnerships with prominent automakers such as General Motors and Ford, positioning it as a key player in the global EV battery market.

Panasonic

Panasonic is another major player in the EV battery industry, particularly through its partnership with Tesla. The company manufactures batteries at Tesla’s Gigafactory and is known for its high-performance lithium-ion batteries.

BYD

BYD, based in China, is both an electric vehicle manufacturer and a battery producer. The company’s vertical integration allows it to control the entire supply chain, making it a formidable player in the EV battery market. BYD is also expanding its reach to global markets, offering batteries to other automakers.

Samsung SDI

Samsung SDI is a major supplier of EV batteries, providing high-quality lithium-ion batteries to several automakers. The company has invested heavily in research and development to enhance its battery technology and is focused on expanding its production capacity.

5. Electric Vehicle Battery Stocks: Key Players

Investors looking to capitalize on the growing EV battery market have several options. The following are some of the top publicly traded companies involved in the production of EV batteries or related components.

Tesla, Inc. (NASDAQ: TSLA)

Tesla is not only the leading electric vehicle manufacturer but also a significant player in the battery market. The company’s Gigafactories produce batteries in partnership with Panasonic, and Tesla is also working on developing its battery technology. Tesla’s stock is highly popular among investors due to its strong growth potential and leadership in the EV industry.

QuantumScape Corporation (NYSE: QS)

QuantumScape is a pioneer in solid-state battery technology, which promises to revolutionize the EV market by offering better energy density, faster charging, and enhanced safety. While still in the developmental phase, QuantumScape’s stock has attracted attention from investors due to its potential to disrupt the lithium-ion battery market.

Albemarle Corporation (NYSE: ALB)

Albemarle is a leading producer of lithium, a critical component in EV batteries. The company’s stock is highly correlated with the demand for lithium, making it a direct play on the growth of the EV battery market. Albemarle has seen significant growth in recent years as the demand for lithium skyrockets.

LG Chem Ltd. (KRX: 051910)

LG Chem, through its subsidiary LG Energy Solution, is one of the largest producers of EV batteries. The company supplies batteries to automakers such as Tesla, General Motors, and Hyundai. LG Chem’s stock has been a strong performer, benefiting from the global EV boom.

NIO Inc. (NYSE: NIO)

NIO is a Chinese electric vehicle manufacturer that also produces its batteries. The company has been expanding rapidly and is considered one of Tesla’s main competitors in China. NIO’s stock has gained popularity among investors looking to capitalize on the growth of the Chinese EV market.

BYD Company Limited (HKG: 1211)

BYD is both an automaker and a battery manufacturer, offering investors exposure to both sides of the EV market. The company’s stock has been on the rise, driven by strong demand for its electric vehicles and batteries in China and international markets.

Panasonic Corporation (OTCMKTS: PCRFY)

Panasonic is a key player in the EV battery market, supplying batteries to Tesla and other automakers. The company has been expanding its battery production capabilities and investing in new technologies to improve battery performance. Panasonic’s stock is a solid option for investors looking for exposure to the EV battery market.

6. Growth Potential and Future Trends

The EV battery market is poised for significant growth in the coming years, driven by the rising demand for electric vehicles and advancements in battery technology. However, several challenges need to be addressed, including the scarcity of raw materials like lithium and cobalt, and the environmental impact of battery production.

Solid-State Batteries: The Next Big Thing

One of the most promising advancements in EV battery technology is the development of solid-state batteries. These batteries offer higher energy density, faster charging times, and improved safety compared to traditional lithium-ion batteries. Several companies, including QuantumScape and Toyota, are working on bringing solid-state batteries to the market, which could revolutionize the EV industry.

Sustainability and Recycling

As the demand for EVs grows, so does the need for sustainable battery production and recycling. Companies are investing in technologies to recycle batteries and reduce the environmental impact of mining raw materials. Governments are also implementing regulations to ensure that EV batteries are recycled efficiently.

Energy Storage Solutions

In addition to powering electric vehicles, batteries play a crucial role in energy storage solutions for renewable energy sources like solar and wind power. Companies involved in the development of energy storage solutions are likely to benefit from the growing demand for clean energy.

7. Risks and Considerations for Investors

While the EV battery market presents substantial growth opportunities, it is not without risks. Investors should consider the following factors before investing in EV battery stocks:

- Market Volatility: The EV market is still relatively young and can be volatile, with stock prices fluctuating based on market sentiment, government policies, and technological advancements.

- Supply Chain Challenges: The production of EV batteries relies on the availability of raw materials like lithium, cobalt, and nickel, which are subject to supply chain disruptions and price volatility.

- Technological Risks: The rapid pace of technological advancements in battery technology means that companies could quickly become obsolete if they fail to innovate.

Top EV Companies in India: Pioneers of the Electric Revolution

India’s electric vehicle (EV) market is witnessing significant growth, driven by government policies, rising fuel costs, and a shift toward greener technologies. Several companies have emerged as key players in the EV ecosystem, focusing on electric cars, bikes, buses, and charging infrastructure. Let’s dive into the details of the top EV companies in India that are shaping the future of transportation.

1. Tata Motors

Tata Motors is at the forefront of India’s EV market, with a strong lineup of electric vehicles. The company’s Nexon EV is one of the best-selling electric cars in India. Tata’s commitment to sustainable mobility extends beyond passenger cars, as it also offers electric buses and trucks through its subsidiary, Tata Motors Electric Mobility. The company aims to build a robust EV ecosystem by developing affordable electric vehicles and expanding charging infrastructure.

Key Models:

- Tata Nexon EV

- Tata Tigor EV

- Tata Ace EV (Commercial)

Future Plans: Tata Motors is investing in battery technology and plans to introduce new EV models in various price segments.

2. Ola Electric

Ola Electric, a subsidiary of Ola Cabs, has gained significant attention in the two-wheeler EV segment. Ola’s S1 and S1 Pro electric scooters are known for their stylish design, advanced features, and impressive range. The company is building one of the world’s largest electric scooter manufacturing plants, known as the Ola Futurefactory, in Tamil Nadu.

Key Models:

- Ola S1

- Ola S1 Pro

Future Plans: Ola Electric aims to expand into electric four-wheelers and is working on developing an EV ecosystem, including charging infrastructure and battery-swapping stations.

3. Ather Energy

Ather Energy, backed by Hero MotoCorp, has made a mark in the premium electric scooter segment with its smart and connected scooters. The Ather 450X and Ather 450 Plus have gained popularity due to their performance, sleek design, and innovative features, such as an integrated dashboard with smartphone connectivity.

Key Models:

- Ather 450X

- Ather 450 Plus

Future Plans: Ather Energy plans to expand its production capacity and increase its presence in more cities across India, along with strengthening its charging network, Ather Grid.

4. Hero Electric

Hero Electric is one of India’s oldest and largest electric two-wheeler manufacturers, offering affordable and eco-friendly mobility solutions. The company’s range of electric scooters is targeted at everyday commuters, and Hero Electric focuses on making EVs accessible to the masses.

Key Models:

- Hero Electric Optima

- Hero Electric Photon

- Hero Electric NYX

Future Plans: Hero Electric plans to ramp up production to meet the growing demand for electric two-wheelers. The company is also working on expanding its dealership and service network across the country.

5. Mahindra Electric

Mahindra Electric is a pioneer in electric mobility in India, with its first electric vehicle, the e2o, launched years ago. Today, Mahindra offers a range of electric vehicles, including commercial and passenger vehicles. Its electric three-wheeler, the Treo, is particularly popular for last-mile connectivity.

Key Models:

- Mahindra eVerito

- Mahindra Treo (Three-Wheeler)

Future Plans: Mahindra is focusing on expanding its EV portfolio and investing in electric SUVs. The company is also working on developing electric powertrains and battery management systems.

6. MG Motors India

MG Motors has gained a foothold in the Indian EV market with its electric SUV, the MG ZS EV. Known for its premium features, safety standards, and advanced technology, the ZS EV caters to the higher-end market segment. MG is committed to promoting sustainable transportation and aims to expand its EV lineup in the coming years.

Key Models:

- MG ZS EV

Future Plans: MG Motors is planning to launch more EV models in India and collaborate with local partners to establish a strong EV charging infrastructure.

7. BYD India

Chinese EV giant BYD (Build Your Dreams) has entered the Indian market with its electric buses and premium electric MPVs. BYD has established itself as a leading player in the commercial EV segment, offering electric buses to various state transport corporations.

Key Models:

- BYD e6 (MPV)

- BYD K9 (Electric Bus)

Future Plans: BYD is focused on expanding its commercial EV offerings in India and is eyeing the electric passenger car market. The company is also working on enhancing its local manufacturing capabilities.

Best EV Stocks in India – Based on The Highest Daily Volume

As the electric vehicle (EV) revolution gathers speed, India’s stock market is seeing increasing interest in EV-related companies. Investors are now closely tracking companies that are innovating in the EV space, from vehicle manufacturers to battery makers and infrastructure developers. A key indicator of the market’s confidence in a stock is its daily trading volume. Higher volumes often signify liquidity and strong investor interest, making these stocks attractive for short-term traders and long-term investors alike.

In this post, we highlight some of the best EV stocks in India based on the highest daily trading volumes.

1. Tata Motors (NSE: TATAMOTORS)

Tata Motors, a leader in the Indian automotive industry, has made significant strides in the EV sector with its Nexon EV and Tigor EV models. The company’s stock has consistently seen high daily volumes, reflecting investor confidence in its EV plans. Tata Motors’ commitment to expanding its electric vehicle portfolio and setting up robust charging infrastructure has attracted attention from both retail and institutional investors.

Why Invest?

- Strong market presence in the passenger and commercial vehicle segments.

- Ambitious EV expansion plans.

- Continuous technological innovation and battery efficiency improvements.

2. Mahindra & Mahindra (NSE: M&M)

Mahindra & Mahindra has been a key player in India’s push towards electric mobility. With its launch of the e-Verito and plans for more electric SUVs, M&M’s stock has seen a surge in daily trading volumes. The company is also making strides in EV battery technology and renewable energy integration, further fueling investor interest.

Why Invest?

- Strong legacy in the automotive sector.

- Expanding EV portfolio and collaborations in the EV ecosystem.

- Increasing focus on sustainable mobility.

3. Amara Raja Batteries (NSE: AMARAJABAT)

Amara Raja Batteries is one of the largest battery manufacturers in India, and with the rise in demand for EV batteries, it has become a crucial player in the market. The company has been increasing its focus on lithium-ion batteries, and its stock has consistently high daily trading volumes, driven by investor confidence in its growth prospects in the EV battery segment.

Why Invest?

- Diversified energy storage solutions.

- Growing presence in the EV battery segment.

- Strong R&D focus on future battery technologies.

4. Exide Industries (NSE: EXIDEIND)

Exide Industries is another top player in the Indian battery manufacturing industry, with a growing focus on the EV market. The company is heavily investing in R&D for advanced battery technologies and has partnered with international firms to bring cutting-edge solutions to the Indian market. Its stock enjoys high liquidity and consistent trading volumes.

Why Invest?

- An established player in the battery industry.

- Investments in advanced battery technologies.

- Strong financials and market penetration.

5. Greaves Cotton (NSE: GREAVESCOT)

Greaves Cotton has been gaining momentum in the EV space with its acquisition of Ampere Vehicles, a major player in the electric two-wheeler market. With the rise in electric scooters and the growing market for affordable electric vehicles, the company’s stock has witnessed an uptick in daily trading volumes.

Why Invest?

- A growing player in the electric two-wheeler market.

- Strong financial backing and market penetration.

- Focus on affordable and sustainable electric mobility solutions.

6. Hindustan Motors (NSE: HINDMOTORS)

Although Hindustan Motors has been relatively quiet for years, its recent moves in the EV segment have sparked renewed interest. With strategic partnerships and plans to manufacture electric vehicles, the company’s stock has started to see higher trading volumes as investors anticipate its potential revival in the EV space.

Why Invest?

- Revamping its business with a focus on electric vehicles.

- Strategic partnerships aimed at EV manufacturing.

- Potential for growth as an emerging player in the EV market.

Top EV Companies in India

The electric vehicle (EV) industry in India is growing rapidly, fueled by government initiatives, rising environmental concerns, and advancements in technology. For investors, the return on investment (ROI) is a critical factor when evaluating EV companies. This post highlights the top EV companies in India based on ROI, offering insights into their market performance, growth potential, and strategic advantages.

1. Tata Motors Ltd.

Tata Motors is a leader in India’s EV space, with a strong portfolio that includes models like the Nexon EV and the Tigor EV. The company has benefited from early entry into the EV market, and its aggressive expansion plans have contributed to solid returns for investors.

ROI Factors:

- Market leadership in passenger EVs.

- Continuous product innovation and technological advancements.

- Strong focus on developing charging infrastructure and partnerships.

2. Mahindra Electric Mobility Ltd.

Mahindra has a deep history in electric mobility, with vehicles ranging from e-autos to electric cars like the e-Verito. The company’s diversified portfolio and strategic investments in sustainable mobility solutions have yielded a steady ROI for investors.

ROI Factors:

- Diverse product range across different EV segments.

- Heavy investment in R&D for battery and motor technology.

- Government subsidies and incentives supporting expansion.

3. Olectra Greentech Ltd.

Electra is a pioneer in electric buses, and it has established itself as a significant player in the commercial EV sector. With its focus on clean public transport, the company has secured government contracts and partnerships with major city transportation systems.

ROI Factors:

- Dominant position in the electric bus segment.

- Strategic partnerships with state governments for public transportation.

- Long-term contracts ensure consistent revenue.

4. Ashok Leyland (Switch Mobility)

Ashok Leyland, through its subsidiary Switch Mobility, is making great strides in the electric bus and light commercial vehicle segments. The company’s strong brand recognition and focus on sustainable mobility have contributed to a promising ROI.

ROI Factors:

- Expansion into the electric commercial vehicle market.

- Global partnerships enhancing technological capabilities.

- Focus on electric buses and eco-friendly public transport systems.

5. Hero Electric

Hero Electric is one of India’s largest two-wheeler EV manufacturers. The company has capitalized on the increasing demand for electric scooters and bikes, especially in urban areas, where EVs are becoming the preferred mode of transport for short commutes.

ROI Factors:

- Leading position in the electric two-wheeler market.

- Strong dealership network and sales channels across India.

- Increasing demand for affordable and eco-friendly commuting options.

6. Ather Energy

Ather Energy is known for its high-performance electric scooters, particularly the Ather 450X, which has garnered widespread attention for its design, technology, and innovation. The company has been successful in attracting investors with its premium offerings and strong market positioning.

ROI Factors:

- Premium product positioning with a tech-savvy customer base.

- Strong focus on building charging infrastructure through Ather Grid.

- Impressive sales growth in key urban markets.

7. Greaves Electric Mobility (Ampere Vehicles)

Ampere Vehicles, a subsidiary of Greaves Cotton, is quickly rising in the EV space with its affordable electric scooters and e-rickshaws. The company focuses on the mass market, offering cost-effective solutions for both personal and commercial use.

ROI Factors:

- Increasing market share in the affordable EV segment.

- Strong focus on electric three-wheelers for last-mile connectivity.

- Expansion into rural and semi-urban markets.

Feature Best EV Stocks in India

India’s electric vehicle (EV) industry is witnessing exponential growth, driven by government initiatives, rising environmental awareness, and increasing demand for cleaner transportation options. As this sector grows, investing in EV stocks has become attractive for investors. Here are the key features to consider when identifying the best EV stocks in India:

1. Strong Financial Performance

The financial health of a company is a primary indicator of its stock’s potential. Look for companies with:

- Consistent revenue growth: Companies report steady increases in revenue from EV sales, services, or partnerships.

- Profit margins: High-performing EV companies should demonstrate positive or improving margins, especially given the capital-intensive nature of EV manufacturing.

- Low debt levels: Companies with manageable debt are better positioned to navigate challenges in the evolving EV sector.

2. Innovative Product Offerings

Innovation is a hallmark of top-performing EV companies. This includes:

- Advanced technology: Firms that offer cutting-edge battery solutions, autonomous driving technology, or unique features have a competitive edge.

- Diverse EV portfolio: Companies with a variety of EV models, including two-wheelers, three-wheelers, and electric cars, provide broader market coverage.

3. Government Support and Incentives

The Indian government is actively promoting EV adoption through subsidies, tax benefits, and infrastructure investments. The best EV stocks are often those that:

- Leverage government incentives: Companies that benefit from policies such as the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme, and other subsidies.

- Invest in charging infrastructure: Firms developing or partnering for charging stations are well-positioned for long-term growth.

4. Strategic Partnerships and Collaborations

Strategic collaborations can accelerate a company’s EV growth. Look for stocks of companies that have:

- Partnerships with global players: Collaborations with international EV manufacturers or technology firms can drive innovation and market expansion.

- Battery and technology alliances: Companies working with leading producers or developing in-house battery tech can maintain cost advantages.

5. Sustainability and ESG Practices

Environmental, Social, and Governance (ESG) factors are increasingly important for investors. The best EV stocks often belong to companies that prioritize:

- Sustainable practices: Firms with eco-friendly manufacturing processes and a strong commitment to reducing carbon emissions.

- Corporate governance: Companies with transparent, ethical business practices and responsible management.

6. Scalability and Production Capacity

A company’s ability to scale production to meet growing EV demand is crucial for long-term success. Top EV stocks are often found in companies that:

- Strong production capacity: Firms with advanced manufacturing facilities and efficient production processes.

- Expansion plan: Companies investing in new plants, technologies, or markets are better positioned for future growth.

7. Market Leadership and Brand Recognition

Brand loyalty and market position can significantly influence an EV company’s stock value. Leading EV brands tend to:

- Dominate market share: Stocks of companies with a leading share in the Indian EV market are often more stable and profitable.

- Strong customer base: A loyal customer base and a reputation for quality help sustain long-term growth.

8. Positive Investor Sentiment

Stock performance is often driven by market sentiment. Best-performing EV stocks tend to enjoy:

- High trading volumes: Consistently high daily trading volumes indicate strong investor interest and liquidity.

- Positive analyst ratings: Stocks with favorable reviews from financial analysts often attract more investors.

Conclusion

The electric vehicle battery market offers a compelling investment opportunity for those looking to capitalize on the shift toward clean energy and electric mobility. As the demand for EVs grows, so will the need for advanced batteries, positioning companies in this sector for significant growth.

Investors should carefully evaluate the companies involved in EV battery production, considering factors such as technological innovation, partnerships, and raw material availability. While the market presents its share of risks, the long-term growth prospects are undeniably strong, making EV battery stocks an attractive option for investors looking to ride the electric vehicle wave.

Click Here to Know More About Electric Vehicle Battery Stocks

Click Here to Know More About Electric Vehicle Battery Manufacturers in India